Entering the world of real estate investment might feel daunting, especially for those who find themselves as accidental landlords. However, with the right strategies, you can transform a single property into a thriving portfolio. Drawing from decades of personal experience in the Phoenix real estate market, we've witnessed firsthand how the right moves can lead to substantial growth and financial security. In this guide, we'll explore three proven strategies to help you expand your real estate empire, even if you're just starting out. Whether it's refinancing, leveraging the 1031 exchange, or strategically selling, there's a path for you to capitalize on the current market opportunities.

Strategy Number One: Refinance Your Property

We’re talking about putting your equity to work for you. One of the ways to do this is to refinance your existing investment property and pull money out in order to put down on another property. When you have a great property that’s profitable and in good condition, you want to hold onto that asset as long as you can. There’s no need to sell and there’s no need to get bogged down in a 1031 exchange. Instead, you want to access the cash that can help you move forward towards building a bigger portfolio.

Advantages to the Refinance versus the Sale or the Exchange

There are no sales costs involved when you refinance, and that’s a huge advantage to owners who are trying to hold onto their money. The cost of a sale can set you back a bit, sometimes by as much as 10 percent of the value of the home.

There’s no taxation on a refinance. While you’re either going to pay taxes on a sale or defer those taxes during a 1031 exchange, you don’t have to worry about that when you keep the property and refinance the loan.

What about Cash Flow?

It helps to have strong positive cash flow in your Phoenix property before you refinance. You’re taking out a larger loan, essentially, and pulling out the cash that’s already accumulated as equity. This means monthly payments will most likely increase from what they are now unless the mortgage rates are so much better than when you originally financed the home. If you have a solid tenant in place and you know you can count on rent coming in reliably at a level that’s comfortable, you have yet another great reason to refinance.

We always want to keep our cash flow positive. However, even if you suffer a small negative cash flow in the first couple of years after you refinance this property, the tax savings on two properties, the reduction on two loans, and two appreciating assets instead of just one almost always overshadows the small negative cash flow.

Here is a closer look at these possible benefits:

Let’s say your property value is $500,000. At a mortgage with a 7% interest rate, the principal and interest you’re paying (P&I) is $1,818. When you refinance and pull out $100,000 from that property for a down payment on a new investment, you’re getting a 6% interest rate and paying $2,237. Chances are, the rents on your $500,000 rental will still be higher than your payment, and you won’t have to fall into the negative.

Appreciation Benefits: Let’s say you go ahead and purchase a new home in a brand-new subdivision for $400,000 with the $100,000 down payment you were able to make. Now, you have a total value of $900,000 in real estate. That’s the value total on the two homes. Assume it’s increasing 5% annually. Before you had a $500,000-value home increasing 5% annually creating $25,000 in appreciation per year. NOW, you have $900,000, increasing at the 5% rate, which is creating a $45,000 value increase per year.

Depreciation Benefits: Before the refinance, you were depreciating a $500,000 property over 27 years which gave you $18,000 in depreciation. Depending on your tax bracket, you might have been taking away $3,600 in tax savings. Now that figure while you are depreciating the $900,000 value will mean close to $33,000 in depreciation expenses per year, which translates directly to about $6,500 savings a year.

And, let’s not forget: your tenants are paying down your loan. So, with just one rental property, about $3,000 of your mortgage was being paid down annually. But, now with the two loans, about $6,000 is getting paid annually by the tenants in a direct reduction of your loan balance.

As you can see, owning two rental homes at the same time and taking advantage of appreciation and depreciation while enjoying a loan pay-down sets you up for more profit and more success. You are much better off as a real estate investor with two properties, even though your payments on your first house increased by $400.00 per month.

This is definitely a good risk to take, especially if you’re interested in growing your real estate empire.

Strategy Number Two: The 1031 Exchange

We talked about how even a new investor with just one property can make a big difference in earnings and potential by refinancing in order to buy a second property.

That’s not the only way.

There’s also the 1031 exchange.

This tool is perfect when you own a property that you would like to change up for a better one.

For example, maybe you have lots of expensive repairs and costs associated with a rental property you currently own, or the rental rates are low in the neighborhood, or perhaps the property was never a good investment and you’ve been looking for a way to give it up without taking too much of a loss on it. In these scenarios, the 1031 exchange can be exactly what you need.

The drawback with the 1031 exchange is that there will be sales costs on selling your property. However, you are not going to have any tax consequences of the sale. Those taxes are deferred when you follow the IRS-implemented guidelines and buy a new property with the proceeds of the sale.

When you’re working through a 1031 exchange, you always want to make sure that you are exchanging a property for one that’s equal in value or a higher value. It’s important to be careful with what you’re appreciating or depreciating. If you’re buying a new construction home after selling one that needs a lot of repairs, you can expect to save a lot of money by not responding to many maintenance calls.

This can work very well. But, we do believe that in most cases, you will benefit more if you purchase two homes and split the equity in the first one. The example that we shared above when we compared owning one house versus two houses still applies in this scenario.

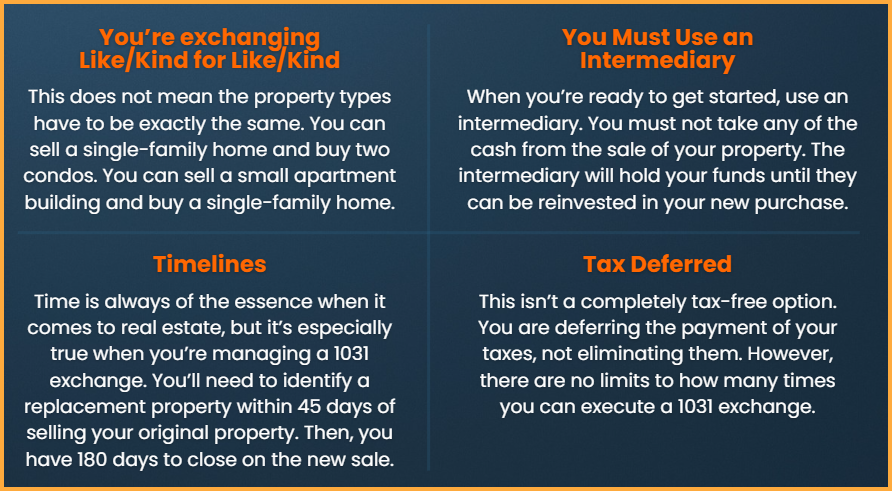

What to Know about a 1031 Exchange

Strategy Number Three: Selling outright, paying Capital Gains Tax and using the proceeds

There’s a third scenario that can help you build a real estate empire in the Phoenix rental market, and that includes paying the capital gains tax on the sale of a property, and buying two or three properties with the proceeds.

This is ideal when your tax bases are too low, and it does not make sense to carry it forward in a 1031 exchange. Yes, there are situations when it is worth paying the tax that you’ll have to pay on the sale of an investment property. That’s because within a couple of years, you make it up by the depreciation tax savings that you’re able to enjoy as a real estate investor who rents out properties.

Let’s look at an example.

Imagine you have a $900,000 home that you bought several years ago for around $400,000.

Your tax bases started at $320,000 and they are giving you $12,000 per year in a depreciation expense. In an effort to build a larger real estate portfolio, you want to sell your home and take the equity to invest it. You will be paying sales costs plus taxes - about $65,000 on your gains at 15% capital gains tax, not considering any improvements that you might have made over the years.

Chances are, you have more than enough money to put down on four homes once you sell that property, each with a $100,000 down payment. This gives you a portfolio of four properties, with a total value of $1,600,000.

This will depreciate at around $46,000 a year, and the higher depreciation will reimburse you for those capital gains taxes within a few short years. So, there is a tipping point where paying the tax on a home that you can sell for a lot of profit is better than a 1031 exchange.

You can go from here and calculate how much more appreciation your $1.6 million portfolio enjoys versus the $900,000 house you might have held onto. You can also calculate the loan pay down on four properties versus one. There’s a lot of potential for real profit here, and it won’t be realized unless you’re willing to sell that $900,000 home, and pay the taxes.

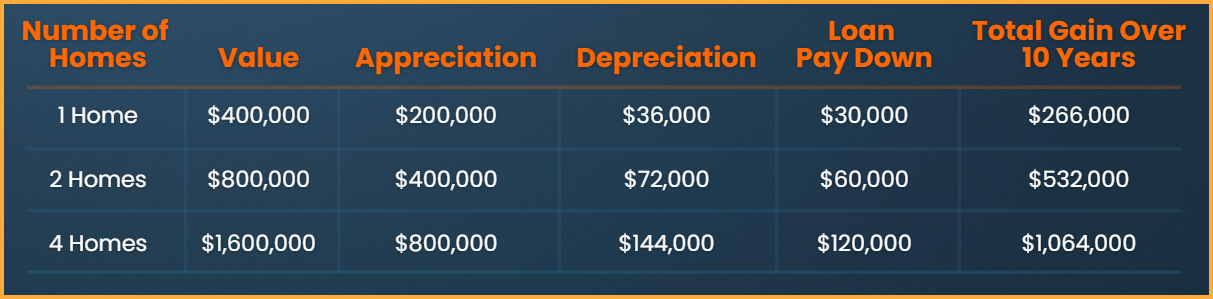

Let’s take a look at how these gains over 10 years can compare on the one, two, or four homes you may own as a Phoenix real estate investor.

Here’s the appreciation, depreciation, loan pay down, and total gains over 10 years:

It’s important for investors to understand that these examples are very rudimentary. This is a pro forma chart that we’re comfortable sharing with you to make a point. These figures more or less are true for the investments that we have made ourselves over the last 20 years.

In the dynamic realm of real estate, making informed decisions is crucial. As we've discussed, refinancing can unlock the equity in your property, the 1031 exchange offers tax advantages for strategic swaps, and selling outright can provide the capital for multiple new investments. These strategies are not just theoretical; they are tried-and-true methods we've applied successfully over the years. By understanding and implementing these approaches, you can position yourself to maximize your profits and secure your financial future. Remember, real estate is not just about owning properties; it's about making your investments work for you.

Now is the time to act. The Phoenix real estate market is ripe with opportunity, and delays could mean missing out on potential gains. We invite you to reach out for a personalized consultation to discuss which of these strategies aligns best with your investment goals. Together, we can craft a plan that leverages our experience and insights to help you build a robust and rewarding real estate portfolio.

Contact us today to take the first step towards expanding your real estate empire.

Service Star Realty

2929 East Camelback Road #119, Phoenix, AZ 85016

(480) 426-9696